It may still be a few weeks before Head Joe Biden signs it, but it looks like the Inflation Saving Act is about to become reality. The legislation passed the Senate, and it now awaits review by the House of government, likely by next week. But the main stumbling blocks have been cleared, making the rest mostly a form.

It remains to be seen whether the Inflation Saving Act in fact reduces inflation. It is, after all, first and chief a costs bill, and new regime costs tends to be inflationary. Eventually, Federal Reserve policy, the untangling of the global supply chain, and augmented energy manufacture to offset the effects of Russian sanctions will have far more impact on inflation.

All the same, this is one of the most noteworthy pieces of legislation in years, and it has major implications for American environmental policy and prescription drug prices.

We’ll start with the two largest talking points: green investment and Medicare pricing. The bill would plow $369 billion into renewable energy investment, counting wind and solar projects, with a goal of sinking carbon emissions by 40% by 2030. It would also expand tax credits for gripping vehicle (EV) buys and promote U.S. energy independence.

The other huge news is that Medicare would be able to negotiate drug prices for the first time, potentially lowering prescription costs for both patients and taxpayers.

Of course, nothing is free. To pay for all of this, the bill would levy a 1% tax on all corporate share buybacks and a 15% minimum corporate income tax on any company with more than $1 billion in revenues.

“We find the the makings tax on share buybacks to be above all appealing,” says Sonia Joao, chief in commission officer of Houston-based RIA Robertson Wealth Management. “Share buybacks have been a well loved way for American companies, and above all tech firms, to reward their shareholders. This may incentivize them to spend less on payouts and more on dividends or debt saving. It’s early, but we could see this having far-ranging implications for the U.S. market.”

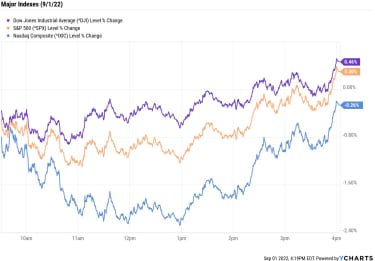

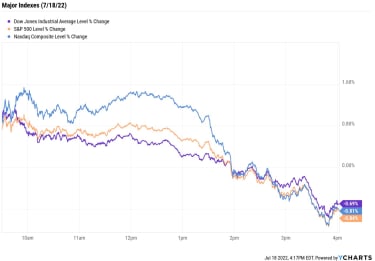

Stock buybacks have added trillions of dollars in buying difficulty over the past decade. In fact, the companies of the S&P 500 bought back approximately $1 trillion in just the past four quarters alone, according to Yardeni Investigate. So, clearly, any noteworthy change in buying patterns will potentially have an outsized impact on the market. It could mean higher dividends, but lower capital appreciation.

Today, we’re going to look at some of the the makings winners and losers of the Inflation Saving Act.

Data is as of Aug. 5.

- Diligence: Auto manufacturers

- Market value: $903.0 billion

One of the most obvious winners of the Inflation Saving Act is gripping vehicle leader Tesla (TSLA, $864.51).

Tesla was an early receiver of federal taxpayer subsidies for EV buys. But sorry to say, the company also became a victim of its own success. By 2018, Tesla had already sold more than 200,000 gripping vehicles, which meant that they had exhausted their regime allowance… and that buyers were no longer free to the $7,500 credit. This place Tesla at a major drawback to younger startups or to habitual automakers that had only just dipped their toes into the EV market, as its harvest were fruitfully $7,500 more pricey.

The Inflation Saving Act lifts the cap, thus making Tesla EVs eligible for the subsidy again.

Subsidies, or the lack thereof, wasn’t Tesla’s only issue, of course. The company faces an attack of new struggle in both gripping vehicles and in independent driving, two areas where Tesla had a major head start. Tesla also has both the blessing and the curse of being run by eccentric billionaire Elon Musk. Musk remains a thinker in the EV space, but his media antics – such as his attempted hold of social media platform Twitter (TWTR) – have proven to be a entertainment.

Still, the return of the subsidy is a huge deal, as is the broader focus on clean, renewable energy. This may have been just the shot in the arm that Tesla’s shares needed.

One caveat: The rebate only applies to cars priced under $55,000. So, Tesla might need to sell a cheaper model or a slimmed down version of its Model 3 if it is to take full benefit.

- Diligence: Sphere chemicals

- Market value: $27.9 billion

A major investment in renewable energy and in gripping vehicles can only mean one thing: a massive boost in demand for energy storage. EVs depend on large battery packs, and storage is a vital part of making solar and wind energy viable replacements for fossil fuels. After all, the sun doesn’t shine at night, and the wind doesn’t blow all the time.

Demand for battery storage means demand for lithium, and that’s excellent news for major lithium producers like Albemarle (ALB, $237.99).

Founded in 1887, Albemarle is a leading global producer of lithium and bromine. Without the raw equipment that ALB produces, there could be no Tesla or any other gripping vehicle. But beyond that, there could be no iPhone or battery-powered laptop pad either. Effectively every wireless electronic gadget you own depends on a lithium ion battery. And those batteries depend on the mining and manufacture of high-quality lithium.

Albemarle isn’t a glitzy tech stock. It’s a gritty equipment stock. But it’s the gritty equipment stock that makes glitzy tech doable.

Demand for lithium was already strong long before the Inflation Saving Act was dreamed up, and demand would take up again to be strong even if the bill somehow died in the House of government. But the the makings boost in demand due to the bill’s climate provisions will only turbocharge ALB even higher.

3 of 7

Startling Winner: Energy Conveying

- Diligence: Oil & gas halfway through

- Market value: $33.4 billion

The Inflation Saving Act is known mostly for its accent on renewable energy. After all, it pledged to reduce conservatory gasses 40% by 2030. But given that West Virginia Senator Joe Manchin’s vote was vital to the bill’s passage – and given the substance of habitual fossil fuels to the Mountain State – there were a few sweeteners for energy and energy infrastructure companies.

At the heart of it is a revision of the permitting process for infrastructure, counting pipelines, that would force the regime to make a declaration on whether or not to issue a permit within two years.

Major pipeline projects, counting the Dakota Access and the Grounding pipelines, have been biased hot potatoes over the past decade. Eliminating some of the uncertainty surrounding new projects – and forcing the regime to give a honest answer in a evenhanded timeline – is a major plus for pipeline operators and above all serial growers like Energy Conveying (ET, $10.82).

ET operates over 120,000 miles of pipeline assets, and approximately 30% of all American natural gas flows through Energy Conveying assets.

Natural gas is thorough a “bridge” energy source by many, or an interim step in transitioning away from dirty coal into clean renewable energy. But it’s a bridge that we may be crossing for decades, and in the meantime, there is money to be made. At current prices, Energy Conveying yields over 8%.

4 of 7

Winner: NextEra Energy

- Diligence: Utilities – corresponding gripping

- Market value: $172.9 billion

The stated aim of the bill, apart from lowering inflation, is to make the U.S. energy grid greener. As such, $113 billion is earmarked to promote the construction of new renewable electricity plants. That should be boon to NextEra Energy (NEE, $87.98) and other utility operators with a major incidence in renewable energy. NEE has ambitious plans in place to eliminate its carbon emissions completely. Already, the company is the world’s largest producer of wind and solar energy.

But the refund to utilities go beyond the incentives to build more room. If the bill is flourishing in advancing the transition to gripping vehicles, then demand for electricity will genuinely rise as drivers use instead a trip to the gas station with an overnight charge in their garage.

And the same holds right for appliances, hot water heaters and home heating systems. While we will still be using natural gas in void construction for decades, new construction will depend far more heavily on electricity.

- Diligence: Consumer electronics

- Market value: $2.66 trillion

Whether or not Apple (AAPL, $165.35) is a winner or loser here will depend on how the company reacts to the tax on stock buybacks. Apple spent over $85 billion on repurchases last year, and in the past decade, that number is close to half a trillion. And this was before the company announced a new $90 billion buyback plot back in April.

Half a trillion dollars is a lot of money, even for a company as large as Apple. And while those buybacks are tribute to the company’s massive success and nearly unbelievable ability to breed mountains of free cash flow, let’s face it: This amount of buying difficulty from Apple’s reserves has clearly had an impact on the share price. This isn’t a testable hypothesis, and we have no way to know what AAPL’s value would be today in the absence of those repurchases. But it’s not a stretch to say that its share price is much higher today than it would have been without all of that bonus buying.

So, no matter what thing that curtails buybacks going forward would be a the makings risk for Apple shareholders.

Now, Apple has options here. They can choose to plow some of that buyback money into higher dividends or even into a one-time special bonus. Or, they could further strengthen their already fort-strong balance sheet by paying down debt.

And it’s completely doable that Apple just continues with its buyback plans and considers the tax a cost of doing affair. The 1% levy really isn’t going to make or break the company.

So, while Apple is a the makings investing loser of the Inflation Saving Act… it’s not likely to lose all that much, and neither are its fellow buy-back hoovering tech competitors, such as Meta Platforms (META) and Alphabet (GOOGL).

6 of 7

Loser: Johnson & Johnson

- Diligence: Drug manufacturers – general

- Market value: $449.9 billion

Huge Pharma will have to negotiate with Medicare going forward. And since Medicare pricing tends to drive the pricing by private indemnity companies as well, the impact on drug costs should be noteworthy. This should be a major win for patients and taxpayers alike.

That said, we have to temper expectations here. The law phases in negotiation in stages, with only 10 drugs subject to negotiation in 2026. And newer drugs would not be eligible for negotiation until at least nine years after their release.

Further complicating this is the fact that we still don’t know which drugs will make the first cut.

Still, a precedent is being set. And future acts of House of representatives will likely accelerate what the Inflation Saving Act has started.

None of this is above all excellent for Huge Pharma giants like Johnson & Johnson (JNJ, $171.11). Given the phased nature of the negotiation, there will be no critical impact on JNJ’s profitability. But it’s coming, so investors should be set.

- Diligence: Internet retail

- Market value: $1.43 trillion

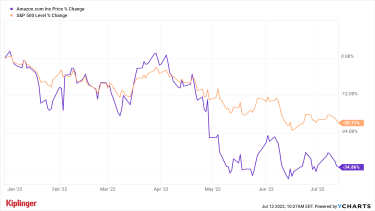

Amazon.com (AMZN, $140.80) is a wonder of modern capitalism. Amazon in effect made the e-buying economy from scratch and then followed that up by making the cloud computing economy from scratch. It’s honest to say that AMZN is the most influential company of the past 30 years, and it has done more to develop the way we live than any other company of our lifetimes.

AMZN also happens to be a pioneer in legal tax averting. Despite generating $35.1 billion in U.S. profits in 2021, the company loved a federal income tax rate of just 6.1%, according to the Institute on Taxation and Fiscal Policy.

Now, to be clear, Amazon did nothing “incorrect” by avoiding taxes. We all do all in our power to lower our tax bills, and AMZN simply took benefit of the opportunities open. It would be doing a incorrect to its investors to not take benefit.

Well, that landscape is now varying. Under the Inflation Saving Act, companies with at least $1 billion in profits would be vital to pay a minimum tax rate of 15% on their reported profits.

Amazon will take up again to mint money. But going forward, it’s going to have to share a larger chunk of it with Uncle Sam, which means less for those invested in AMZN stock.