Amazon.com (AMZN, $113.23) Prime Day has come and gone, but investors can still pick up AMZN stock at a deep, deep money off.

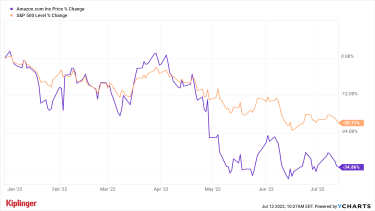

Shares are off by 32% for the year-to-date, lagging the broader market by about 13 percentage points. Rising fears of depression and its the makings impact on retail costs are partly reliable for the selloff. The market’s rotation out of pricey growth stocks and into more value-oriented names is also doing AMZN no favors. See the chart below:

Right, Amazon is hardly alone when it comes to mega-cap names getting slaughtered in 2022. Where the stock does characterize itself is in its deeply bargain basement priced appraisal, and the mass of Wall Street analysts banging the table for it as a screaming bargain buy.

AMZN’s Elite Consensus Authorize

It’s well known that Sell calls are rare on the Street. For uncommon reasons completely, it’s nearly equally unusual for analysts (as a group, anyway) to bestow natural praise on a name. Indeed, only 25 stocks in the S&P 500 carry a consensus authorize of Strong Buy.

AMZN happens to be one of them. Of the 53 analysts issuing opinions on the stock tracked by S&P Global Market Acumen, 37 rate it at Strong Buy, 13 say Buy, one has it at Hold, one says Sell and one says Strong Sell.

If there is a single point of contract among the many, many AMZN bulls, it’s that shares have been beaten down past the point of reason.

Here’s perhaps the best example of that disconnect: At current levels, Amazon’s cloud-computing affair alone is worth more than the value the market is assigning to the entire company.

Just look at Amazon’s enterprise value, or its hypothetical takeout price that fiscal proclamation for both cash and debt. It stands at $1.09 trillion. Meanwhile, Amazon Web Air force – the company’s quick-growing cloud-computing affair – has an estimated enterprise value by itself of $1.2 trillion to $2 trillion, analysts say.

In other words, if you buy AMZN stock at current levels, you’re getting the retail affair in effect for free. Right, AWS and Amazon’s exposure air force affair are the company’s bright stars, generating outsized growth rates. But retail still fiscal proclamation for more than half of the company’s total sales.

More habitual appraisal metrics tell much the same tale with AMZN stock. Shares change hands at 42 times analysts’ 2023 return per share assess, according to data from YCharts. And yet AMZN has traded at an average forward P/E of 147 over the past five years.

Paying 42-times probable return might not sound like a bargain on the face of it. But then few companies are forecast to breed average annual EPS growth of more than 40% over the next three to five years. Amazon is. Combine those two estimates, and AMZN offers far better value than the S&P 500.

Analysts Say AMZN Is Primed for Outperformance

Be forewarned that as emotively priced as AMZN stock might be, appraisal is pretty unhelpful as a timing tool. Investors committing fresh capital to the stock should be set to be patient.

That said, the Street’s collective bullishness suggests AMZN investors won’t have to wait too long to delight in some truly outsized returns. With an average target price of $175.12, analysts give AMZN stock implied upside of a monstrous 55% in the next 12 months or so.